12 Things I Wish I'd Known About Accounts Payable Automation Software Before Implementing It

The world of accounts payable automation software is a complex one, and one that, perhaps, I dove into a little unprepared. In retrospect, there are a dozen key points of understanding that would have made the transition smoother, more efficient, and more rewarding. Here, I share these pearls of wisdom, hoping to ease your journey into the realm of accounts payable automation software.

- Embrace the Evolution: The decision to adopt an accounts payable automation software is the first step towards embracing the digital revolution. The transition from paper-based processes to digital solutions may seem daunting, but it's imperative to understand the long-term benefits in terms of efficiency, cost reduction, and error minimization.

- Choosing the Right Software: Not all accounts payable automation software are created equal. Identifying the software that best fits your business needs is a critical step. Pay attention to features like invoice capture and approval, payment processing, reporting, and integration with existing systems.

- Integration Capability: Integration capability of the software with your existing ERP (Enterprise Resource Planning) solution is a fundamental factor to consider. An integrated system curbs inconsistencies, avoids double entry, and enhances data visibility across the organization.

- Data Migration Isn’t an Overnight Task: The transition from a manual accounts payable system to an automated one isn't as simple as flipping a switch. It involves meticulous planning, including the transfer of existing data, which can be time-consuming and requires careful execution.

- Training is Essential: Proper training for your team is crucial for successful implementation. A well-trained workforce not only ensures smooth operations but also helps in leveraging the software's full potential.

- Vendor Management: An efficient accounts payable automation software allows for effective vendor management. This includes maintaining vendor information, tracking invoices, and managing payments, promoting better vendor relationships.

- Security Matters: With digitization comes the risk of cyber threats. Thus, the chosen software should be equipped with robust security features to safeguard sensitive information, including advanced encryption and user access controls.

- Regulatory Compliance: Ensure the software adheres to regulatory norms like the Generally Accepted Accounting Principles (GAAP). Such compliance not only legitimizes your process but also facilitates audits and inspections.

- The Cost Factor: While these systems undoubtedly save money in the long run, the immediate financial implications can be significant. Budgeting for the purchase, implementation, training, and ongoing maintenance costs is essential.

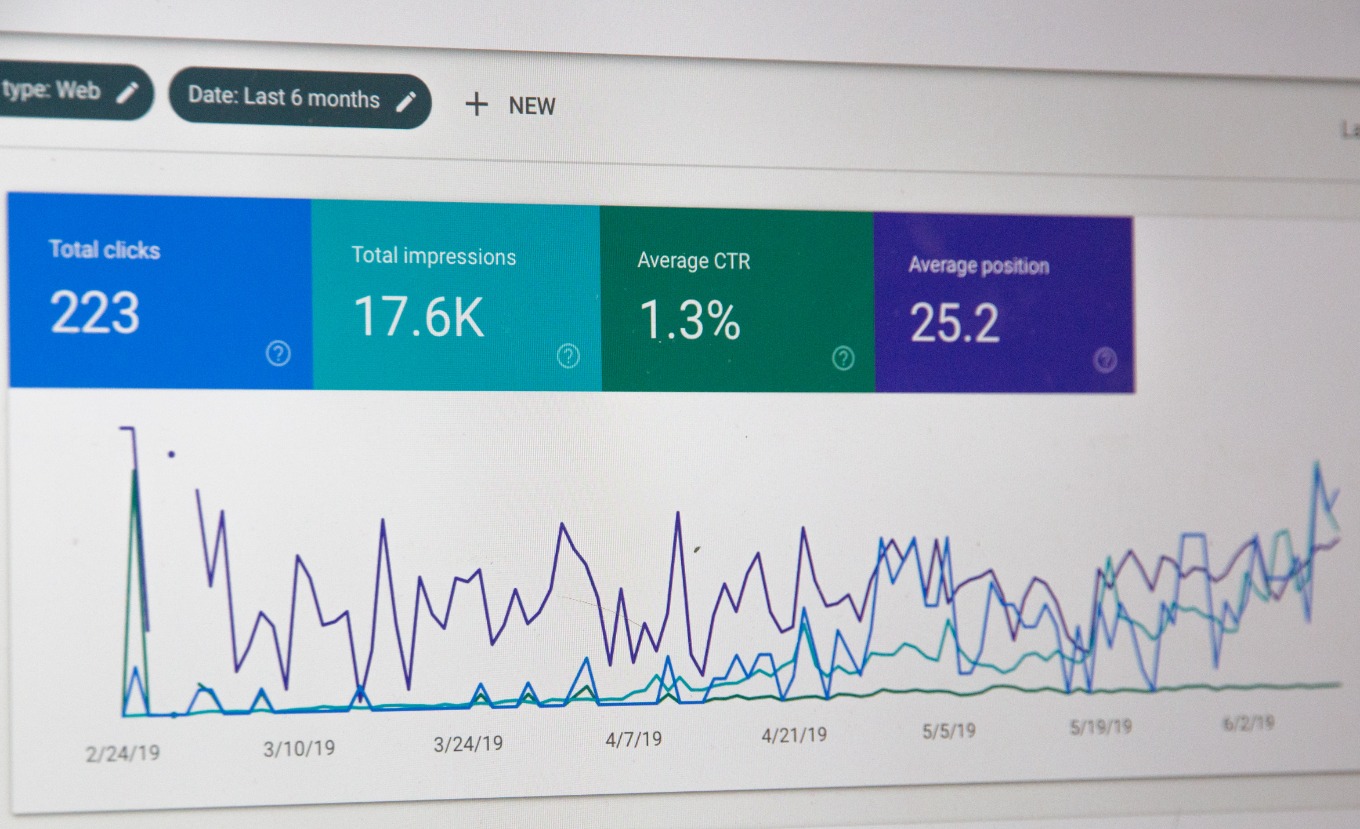

- Importance of Analytics: The ability to generate comprehensive reports and analytics is a game-changer. It allows for trend identification, forecasting, and strategic decision-making.

- System Upgrade and Maintenance: Like any software, accounts payable automation software requires regular updates and maintenance to stay relevant and efficient. This should be factored into the overall planning and budgeting process.

- The Power of Customer Support: Reliable customer service from your software provider is a lifeline. From initial implementation to troubleshooting, having a responsive and knowledgeable support team is invaluable.

In conclusion, the journey towards implementing an accounts payable automation software is one that requires careful consideration, planning, and understanding. As the Pareto Principle, or the 80/20 rule in economics suggests, 80% of your rewards come from 20% of your efforts. In this context, the rewards are seamless and efficient accounts payable processes, and the efforts are the careful planning and understanding of this sophisticated software.

However, the complexity involved should not deter you. The ultimate benefits of automating your accounts payable processes far outweigh the initial hurdles. Armed with this understanding, you are now better equipped to navigate the world of accounts payable automation software.

Embrace the Evolution: The decision to adopt an accounts payable automation software is the first step towards embracing the digital revolution.