About BILL

San Jose, CA, USA

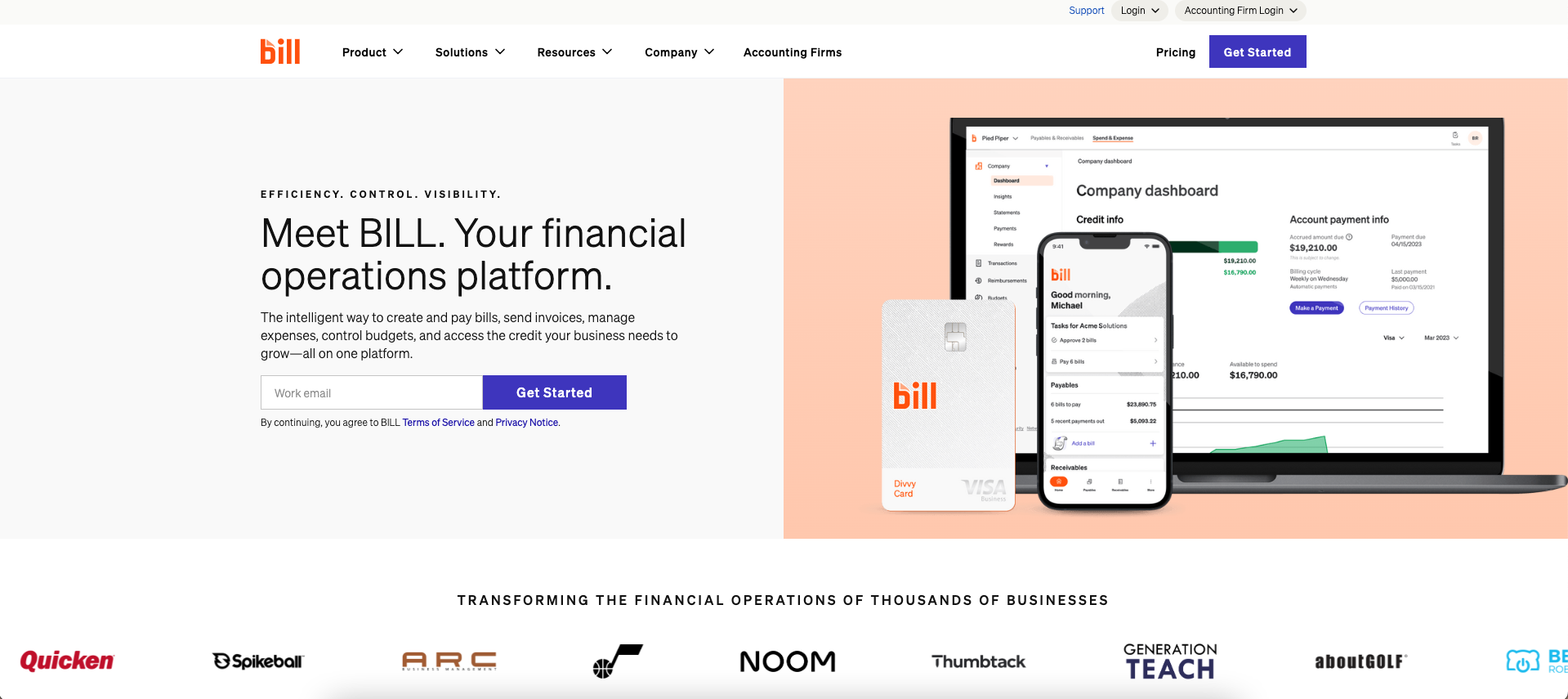

In the fast-evolving space of accounts payable automation software, BILL emerges as a substantial player aiming to streamline the financial operations for businesses, both big and small. The company's comprehensive suite promises to simplify what can often be a convoluted process, ensuring that paying bills, managing invoices, and tracking expenses become less of a chore and more of a strategic component of business management.

At its core, BILL offers a centralized platform that integrates various financial tasks into a cohesive system. This integration is particularly beneficial for small to midsize businesses looking to scale their operations without proportionally increasing their administrative burden. The platform's ability to sync seamlessly with leading accounting software is a standout feature, underscoring the company's commitment to interoperability and user convenience. For instance, BILL's compatibility with QuickBooks, Sage Intacct, and Oracle Netsuite, among others, is a testament to its flexibility, allowing users to maintain their existing accounting ecosystems while leveraging BILL's automation capabilities.

One of the hallmarks of BILL's service is the automation of accounts payable. This feature not only saves time but also reduces the potential for human error in payment processing. The simplification of the approval workflow and the option to manage payments via a dedicated accountant dashboard signal a well-considered design that caters to the needs of financial teams. Moreover, the provision of a mobile app adds an element of agility, granting the ability to manage payments on the go—a boon for professionals in an increasingly mobile work environment.

Another compelling aspect of BILL is its spend and expense management module. The platform extends beyond mere automation, offering strategic tools like budget management and financial insights that empower businesses to make informed decisions. The access to credit lines and the innovative use of corporate cards within the system reflect a nuanced understanding of cash flow management, which is crucial for businesses looking to optimize their financial health.

While BILL positions itself as an efficient and user-friendly solution, it's important to note that any technology adoption comes with a learning curve. The plethora of features, while advantageous, may require a period of adjustment for users. However, the company's commitment to training and support is evident, with resources like the Learning Center and Business Templates aimed at facilitating a smoother transition.

In comparison to other players in the industry, BILL stands out for its integrated approach and its attention to the user experience. Features such as automatic syncing with accounting software, versatile payment options, and comprehensive mobile capabilities distinguish BILL from competitors who may offer more segmented or less user-centric solutions.

In conclusion, BILL presents an attractive proposal for businesses looking to automate their financial back-office operations. Its focus on integration, ease of use, and strategic financial management tools positions it as a strong candidate for companies eager to embrace efficiency without sacrificing control over their finances. While it's not without its complexities, the potential for streamlined operations and improved financial oversight makes BILL a compelling choice in the accounts payable automation software market.

Fast Facts

- BILL's financial operations platform is used by over 5.8 million network members.

- The platform has facilitated a total payment volume of approximately $266 billion annually, which is about 1% of the US GDP.

- Surveyed users report an average monthly savings of over $10,000 by using BILL's services.

- On average, users save about 12 hours per month by using BILL's Spend and Expense platform.

- BILL's platform offers comprehensive suites including accounts payable, accounts receivable, spend and expense management, all integrated into one system.

- BILL's financial operations platform allows for seamless integration with leading accounting software such as QuickBooks, Sage Intacct, Oracle Netsuite, and Microsoft Dynamics.

Products and Services

- "BILL Accounts Payable" - Automate the entire accounts payable process, from bill creation to approvals and payments, with seamless integration to accounting software.

- "BILL Spend & Expense" - Manage business expenses and access credit lines with software that combines fund requests, budget tracking, and corporate card management.

- "BILL Accounts Receivable" - Create professional invoices and receive payments directly to your bank account via ACH or credit card, facilitating a faster payment process.

- "BILL Financial Operations Platform" - Automate financial operations across AP, AR, spend, and expense management with a unified tech stack integration and a single login.

Want to learn more?

Click here to check out the rest of our rankings and reviews.