About Melio

New York, NY, USA

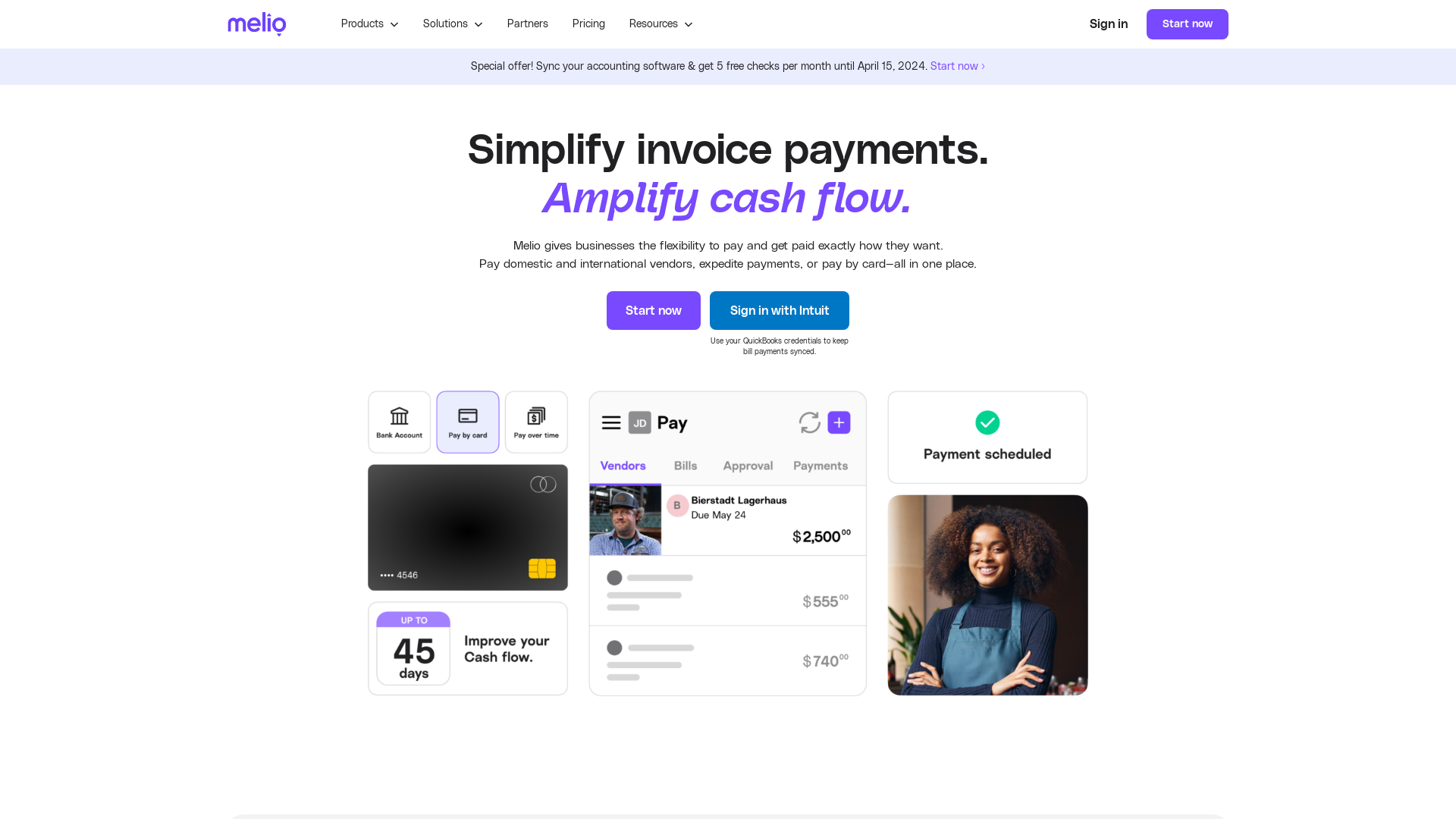

In the world of small business finance, managing accounts payable can often be a daunting and time-consuming task. Enter Melio, an accounts payable automation software that aims to simplify the bill payment process for small business owners and accountants alike. What sets Melio apart is its dedication to a user-friendly experience that prioritizes ease of use and flexibility in payment options.

At first glance, Melio presents a sleek and intuitive interface that even the least tech-savvy users can navigate with ease. The platform offers a mobile app that allows users to send and track payments on the go, which is a big plus for business owners who are always on the move. The ability to sync with popular accounting software such as QuickBooks and Xero, provides a seamless integration that reduces the likelihood of dual data entry and simplifies the reconciliation process. This feature alone could save users countless hours that would otherwise be spent manually updating ledgers.

Another highlight of Melio's service is the array of payment options it provides. Users can schedule free ACH bank transfers or make card payments even where cards are not accepted, which can be particularly useful for managing cash flow or taking advantage of credit card rewards programs. The platform also offers international payments, which is a vital feature for businesses working with overseas suppliers.

Melio's focus on security is evident in their offering of virtual cards for online business expenses, which can help protect users from fraud and check forgery. The company also emphasizes control over the payment process, allowing users to assign roles and permissions, and digitize approval workflows. This degree of transparency is crucial for maintaining oversight of business expenses.

While Melio offers a range of features that make it a strong contender in the accounts payable automation space, it's worth noting that the platform is particularly tailored to small businesses. Larger enterprises with more complex financial structures may find the tool's capabilities a bit limited. However, for small businesses looking to streamline their financial operations without the need for extensive training or a large financial outlay, Melio is a solid choice.

It's important to consider the cost-benefit aspect of any financial tool, and Melio scores well on this front too. The service is free to sign up, and sending ACH to ACH bank transfers are cost-free, which is quite competitive. For instant payments, there's a 1.5% fee, capped at $50, which seems fair for the convenience it offers.

Overall, Melio's simplicity, cost-effectiveness, and flexible payment options make it an attractive option for small businesses seeking to optimize their accounts payable process. The platform doesn't overcomplicate features but instead, provides straightforward solutions that address the core needs of its users. In a market where financial software can often feel overwhelming, Melio's straightforward approach is a breath of fresh air for small business owners looking to get back to what they love—running their business.

Fast Facts

- Melio offers free ACH to ACH bank transfers for payment processing.

- Using Melio, vendors can be paid instantly with a 1.5% fee, capped at $50.

Products and Services

- Accounts Payable - Manage bill payments to vendors and suppliers with options for scheduling, payment methods, and seamless accounting software integration.

- Accounts Receivable - Send invoices and receive online payments, streamlining the billing process with easy tracking and management.

- Accountant Dashboard - A dedicated dashboard for accounting firms to manage various client payments and financial activities efficiently.

- Secure Payment - Create virtual cards for online business expenses, offering a secure payment option to protect against fraud and unauthorized transactions.

Want to learn more?

Click here to check out the rest of our rankings and reviews.